Some findings in a new report may surprise you

We recently wrote about the need for fraud investigation teams in virtually all businesses - and that in most small and mid-sized organizations, there simply aren't sufficient internal resources to deal with occupational fraud.

One of the things we heard most often about that piece was "Come on - big companies need internal fraud squads, but we have less than 1000 employees. We don't have to worry about that kind of thing. Especially not in Canada."

As it happens, the Association of Certified Fraud Examiners recently released their 2018 Report to the Nations Canada Edition , and their findings are interesting - even a little surprising, even to us.

SMEs are at the highest risk for fraud

According to the report, 38% of fraud cases in Canada happened in businesses with fewer than 100 employees, while 24% happened in businesses with 100-1000 employees. In both cases, the median loss was $200,000.

And while the banking and financial services industry definitely attracts more than its fair share of occupational fraud (23% of cases), there are almost no industries which are immune. Manufacturing, transportation, technology, retail, healthcare and construction are all tied at 5%.

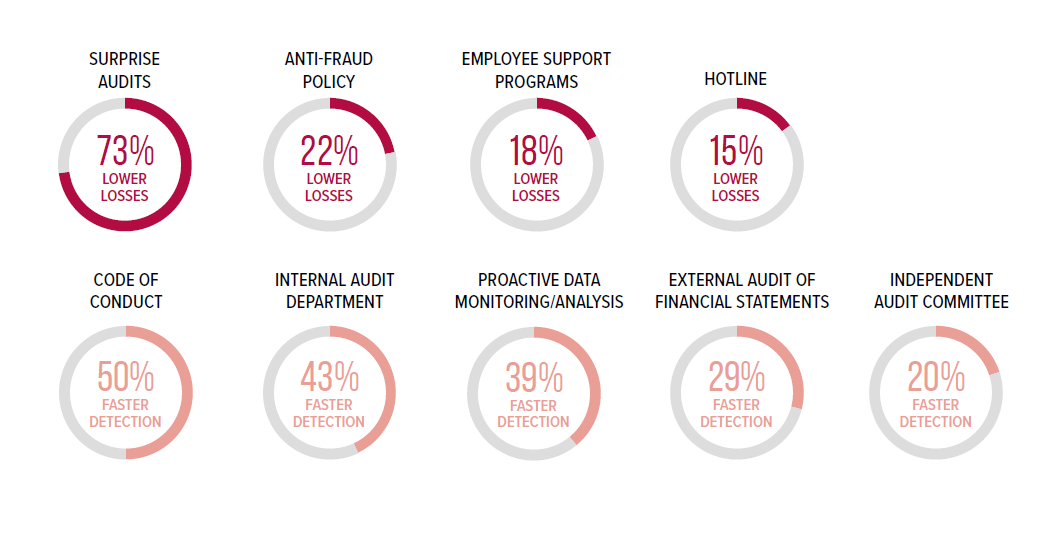

Anti-fraud control: What works?

While many organizations have anti-fraud strategies and tactics in place (the report lists 20+), the truth is that only the right combination of initiatives for faster detection and reducing losses will actually make a real difference.

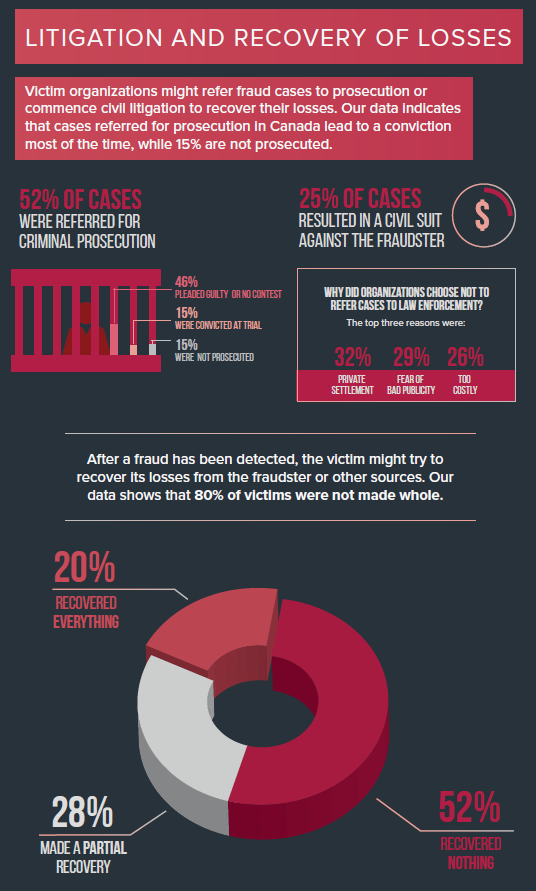

Litigation and loss recovery

While the right preparation, staff and knowledge can reduce the opportunities for fraud, increase the likelihood and speed of detection and limit the losses incurred, 52% of fraud cases are ultimately referred for criminal prosecution.

And while 60% of those cases end with the perpetrator pleading guilty or being convicted at trial, only 20% of organizations manage to recover all their losses.

So how can organizations protect themselves?

From our perspective, the fraud investigations landscape has changed considerably in the past few years, and definitely for the better. Most organizations simply can’t afford to keep enough full-time fraud investigators on staff at all times, and definitely don’t prioritize the training and technology that would keep their fraud staff on the cutting edge. But at the same time, specialized corporate investigations companies (like Profile ) have been able to build nimble investigations teams that can be deployed as the need arises. (This is one of the ways in which the increasing popularity of contract workers can deliver big benefits for organizations.)

We know most employees are good people. But every organization faces fraud challenges from time to time. Professional fraud investigations can ensure that they don’t end up threatening the business.