Fraud happens in organizations. It's important to be prepared.

Most of the time, we see the best of people: Employees who truly come to work every day wanting to work hard and do the right thing; employees who go above and beyond the call of duty when things are difficult; and employees who are genuinely incorruptible.

But sometimes the job means you often see the worst of people: Employees committing fraud or other workplace-related crimes that end up costing both the company and their co-workers a lot of time, money and peace of mind.

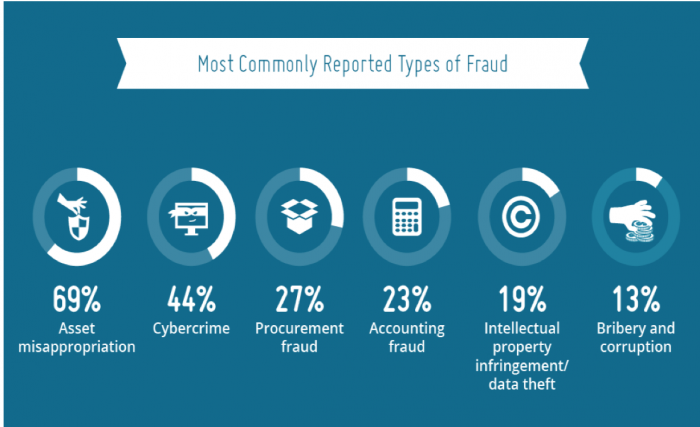

Here's what fraud looks like, broadly speaking:

Now, it's important to remember that 'asset misappropriation' can include small things like the office manager who takes home a few post-it notepads, and 'data theft' can include the grumpy departing sales manager who makes a copy of the client list to take to their new job. Yes, these are fraud, but they're not (generally) going to make or break an entire organization, and they're unlikely to result in jail time.

However, cybercrime, procurement fraud, and bribery/corruption can have enormous consequences for the organization, for their customers, and for society as a whole - and they need to be investigated and stopped.

Every organization has issues.

Not every organization has adequate resources.

When we saw this infographic from E&Y this week, one stat was particularly interesting to us: That organizations with 10,000 employees or more have an average of 59 fraud investigators on staff.

The truth is that in our experience, very few companies outside of banking (and sometimes insurance) keep 60+ fraud investigators in-house, even when they know there'a a need. Possibly more importantly, smaller organizations don't maintain a fraud investigation staff at all (according to this particular study, an organization with 1000 employees would have 6 fraud investigators - but that's almost never the case). What this data also suggests is that the internal fraud investigators may not have access to the most cutting-edge technology that might help them do more, faster and better.

So how can organizations protect themselves?

From our perspective, the fraud investigations landscape has changed considerably in the past few years, and definitely for the better. Most organizations simply can't afford to keep enough full-time fraud investigators on staff at all times, and definitely don't prioritize the training and technology that would keep their fraud staff on the cutting edge. But at the same time, specialized corporate investigations companies (like Profile ) have been able to build nimble investigations teams that can be deployed as the need arises. (This is one of the ways in which the increasing popularity of contract workers can deliver big benefits for organizations.)

We know most employees are good people. But every organization faces fraud challenges from time to time. Professional fraud investigations can ensure that they don't end up threatening the business.